Why homemade carrier connectivity isn’t a winning strategy

(advertorial) The rapid growth of delivery management companies like nShift proves that there is a strong market need for an intermediary handling the communication between shippers and carriers. But why is this a product every shipper needs? Wouldn’t it be easier and more cost efficient to just integrate directly to each carrier yourself? Let’s have history answer that question.

The rapid growth of delivery management companies like nShift proves that there is a strong market need for an intermediary handling the communication between shippers and carriers. But why is this a product every shipper needs? Wouldn’t it be easier and more cost efficient to just integrate directly to each carrier yourself? Let’s have history answer that question.

The pro’s and con’s of direct EDI

The first wave of digitalization of communication between shippers and carriers came during the late 1990’s with the introduction of EDI data transfer. The EDI messages contained the information a carrier would need for correct handling of the shipment as well as billing of the transportation services that shippers were buying, thus making the communication between shipper and carrier and invoicing process more efficient.

However, the EDI data transfer was limiting shippers to only using few carriers, and any change came with a significant internal IT cost. Moreover, track and trace data, i.e. status events sent from the carrier, was usually not implemented leaving the shipper completely blind once the goods had left the warehouse. The result of the direct EDI approach was a very rigid system hindering both the carrier and the shipper from developing and improving the delivery process.

The rise of Delivery Management solutions

The alterative to direct EDIs was to use one of the emerging companies providing what is now called Delivery Management or Multicarrier Parcel Management solutions. These products were at the time essentially EDI engines combined with a validation framework used to safeguard the quality of the data sent to carriers and a label generator. Such solutions were developed with support from, and in close cooperation with carries and they allowed also smaller shippers to start making electronic bookings and helped all shippers to generate correct EDIs and compliant labels.

The development of more advanced transport services including features like complex routing rules, track and trace, pick-up and drop-off (PUDO) points, reservation of delivery slots and a growing number of additional services has since then then made the generation of correct booking messages, not to mention correct labels and transport documents, much more complex. Anyone attempting to build file-based integrations to a modern carrier must be prepared to implement complex validation rules, complicated label layouts, and to store significant amounts of supporting data which must be kept up to date. It is simply not economically viable for an individual shipper to build and maintain bespoke connections.

The takeover of API’s

Most carriers have spent the last ten years developing their own set of APIs targeting shippers. The intention was to replace direct shipper-carrier EDIs with direct API integrations, as these transfer data more efficiently than EDI. However, as there are no market standards defining how to build a set of carrier APIs, each carrier has their own structure and logic. As a result, many shippers have found that their old school, home built, file integration approach is insufficient when they try to connect to modern last mile actors or even just trying to access the latest services offered by any major carrier on the market. The forces shippers to use carriers that only offers APIs and thereby abandon their legacy integration strategy and turn towards a modern solution.

An innovative and dynamic market needs a modern and scalable solution

The pace of innovation is currently very high in the transportation business, spear-headed by the last mile delivery domain. Consumer (receiver) control and fast or even “instant” delivery options introduce new requirements on the communication between the shipper and the carrier. It’s no longer enough just to integrate the WMS or TMS to the carrier and to send data at the end of the day when all parcels and pallets are packed and ready to ship. The communication with the carrier must start already from the customer facing interface such as the online checkout and the entire fulfillment chain must be in sync to make sure that the promises made to the customer are meet.

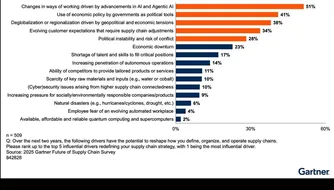

Another result of the highly dynamic transport market is that no shipper can rely on only one or a few carriers. Gartner® states that “Leveraging multiple carriers and services is crucial to providing the best options and offering the most competitive shipping costs”[1]. It’s simply not possible to find a carrier that checks all the boxes on all the markets, especially since the receiver now weighs in on the carrier selection.

So, to answer the questions in the beginning of this blog: Why is a delivery management solution a product every shipper needs? Wouldn’t it be easier and more cost efficient to just integrate directly to each carrier yourself? A modern Delivery Management solution helps shippers cope with all the complexity coming from a wide carrier supplier base, constantly changing technical interfaces and transport service definitions, multiple internal systems, and most importantly rapidly increasing demands from customers. It’s simply impossible for a shipper to acquire and defend a competitive delivery management offering without the help of a Delivery Management provider.